New to 1031 Exchanges or Need a Refresher?

A 1031 exchange allows you to defer the recognition of capital gains tax that would otherwise be due upon the sale of real property held for business or investment purposes.

To estimate how much you can save by structuring your sale as a 1031 exchange, see our website’s capital gains calculator here.

As a 1031 qualified intermediary, we have three primary functions:

- Prepare any required exchange documents for your sale and purchase.

- Hold the net proceeds in escrow, as required by IRC section 1031.

- Provide information and assistance, but not tax or legal advice, to every one of our clients.

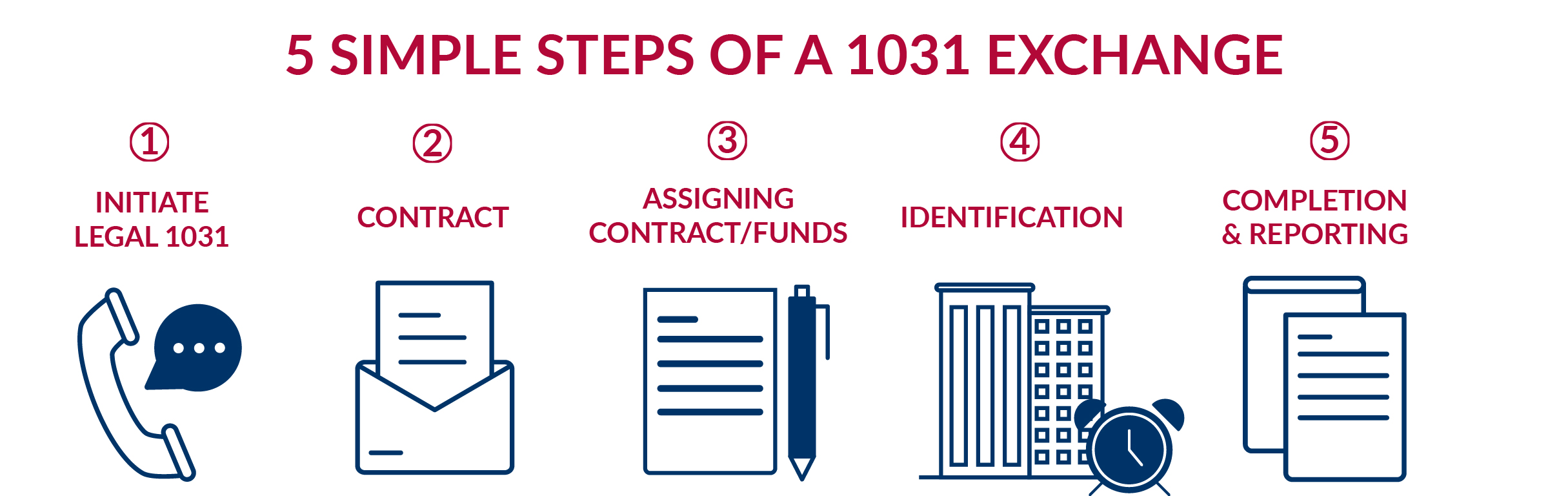

New to exchanges, or just need a refresher? Explore our five simple steps below and feel free to contact us any time for inquiries, information, or to start your exchange. Experience the VIP service that sets us apart.

Some key terms to get started:

The Relinquished Property is the property being sold.

The Replacement Property is the property being purchased.

- Plan your 1031 Exchange: Contact Legal 1031 once you decide to sell your property and always before you close on your sale. Our office will provide you with information regarding your 1031 exchange options. While we can prepare documents right up until the day of the closing, the best plan for success is to speak with us as early as possible. Call a member of our team at (877) 701-1031 or email us at to discuss your options.

- Prepare your 1031 Exchange Documents: Once you have agreed to sell your relinquished property, you will need to provide us with a copy of your Sale Contract. It is always good practice to add a 1031 exchange co-operation clause to your contract; our team can provide you with this language. Our office will use the contract to draft your 1031 relinquished (sale) property documents. To get started, email a copy of your contract to our Processing Team at .

- Relinquished Property Closing: A closing where the sale is structured as a 1031 exchange is just like any typical closing, except (1) the 1031 exchange documents must be signed at or prior to closing, and (2) the net proceeds must be sent directly from closing to Legal 1031 to be held in escrow. This closing starts the exchange timeline and begins both the 180-day period in which to acquire replacement property, as well as the 45-day period in which to identify any replacement property.

- Replacement Property Identification and Purchase: Legal 1031 will provide you with an exchange identification form with which to identify potential replacement property. This form must be completed and returned to Legal 1031 within the first 45 days of your exchange, leaving you with the remaining 135 days of the 180-day exchange timeline to purchase any of the identified properties (or by the tax return deadline, see our Extending Tax Filing Deadlines article.

With limited exception, you will want to ensure that the taxpayer purchasing the replacement property is the same taxpayer who sold the relinquished property.

For e.g. if Main Street, LLC sold relinquished property, it must be Main Street, LLC who is also purchasing the replacement property. Read more about the Same Taxpayer Requirement here.

-

Completion and Reporting: The exchange is completed when the taxpayer has (1) purchased all property that has been identified, or (2) on day-180, whichever comes first, unless there is IRS disaster relief that provides for an extension. Read more about IRS extensions here. To achieve full tax deferral, a taxpayer will want to reinvest an amount equal to or greater than the sale value, which is the combined equity and debt on your relinquished property (this is called “balancing” your exchange). Read more about Balancing here. Report the exchange by filing IRS Form 8824 with your Federal tax return, as well as filing your state and local returns, for the transaction year.

If you’ve recently completed your exchange and are wondering what to do next, read our article, “I’ve Completed my 1031 Exchange, Now What?” for important post-exchange considerations and tips. If you’ve recently completed your exchange and are wondering what to do next, read our article, “I’ve Completed my 1031 Exchange, Now What?” for important post-exchange considerations and tips.

Legal 1031 Exchange Services, LLC can support you through every phase of your 1031 exchange journey. Although we are not permitted by law to provide tax or legal advice, our team of attorneys, CPAs and exchange professionals are a valuable resource that can quickly provide background information and answer any exchange related question. Our exceptional customer service means that we hold our client’s hands throughout the exchange process.

Explore further insights and in-depth articles on 1031 exchanges:

1031 Checklist

The Benefits of a 1031 Exchange

Frequently Asked Questions of a 1031

Common Misconceptions of an Exchange

I’ve Completed my 1031 Exchange, Now What?

Contact us today or schedule a meeting to find out how much you can save by deferring your capital gains taxes.

Legal 1031 Exchange Services, LLC does not provide tax or legal advice, nor can we make any representations or warranties regarding the tax consequences of your exchange transaction. Property owners must consult their tax and/or legal advisors for this information. Our role is limited to serving as qualified intermediary to facilitate your exchange.

© 2023 Legal 1031 Exchange Services, LLC. All rights reserved.