INVESTING IN OPPORTUNITY ZONES

BACKGROUND, BASICS, AND COMPARISON TO 1031 EXCHANGES

by James T. Walther, Esq. LL.M.

Introduction:

Opportunity Zones (OZs) have frequently been a topic of discussion in the news and in the commercial real estate industry, especially after Amazon’s announcement (now rescinded) that it would expand using a development site in an OZ in Queens, NY. Earlier in the year, some professionals opined that OZs will replace Section 1031 exchanges as the “go to” tax deferral strategy for real estate investors because of the potential long-term tax benefits. Such assessments were pre-mature and misguided because they did not consider the implications for different investors/taxpayers or the impact of additional regulations from the Treasury. Section 1031 and Opportunity Zones are different investment strategies that generally appeal to taxpayers with different goals and tax attributes. This memo is intended to provide basic background on OZs and highlight some of the differences between the requirements, advantages, and disadvantages of OZs and 1031 exchanges.

The Opportunity Zone Program: A community development program, offered through the Tax Cuts and Job Acts of 2017 (the “TCJA”), encourages private investment in low-income urban and rural communities and is designed to spur economic development and job creation in distressed communities throughout the United States. The OZ program established by the TCJA is governed by IRC §§1400Z-1 and 1400Z-2 and related regulations. Investors that wish to defer capital gains recognized upon a sale or exchange of an asset to an unrelated party on or prior to December 31, 2026 can invest that gain in a Qualified Opportunity Fund (QOF), which in turn invests in “qualified opportunity zone property” or a “qualified opportunity zone business” as defined by the law.

Zone Designation: Up to a quarter of federally designated Low-Income Communities “LICs” were eligible for OZ designation. Designated census tracts were limited at 25 percent of the total number of eligible census tracts within the state. On June 14th, 2018, the Department of the Treasury certified more than 8,700 census tracts with below average income (according to the 2010 Census) across all states, territories, and the District of Columbia. OZs have an average poverty rate of nearly 31 percent and an average median family income of only 59 percent of its area median, compared to the 80 percent eligibility threshold. Selected census tracts have a high need, as well as growth potential, and they include tracts contiguous to LICs which meet a certain median family income threshold.

QOF Process and Requirements: Proposed Regulation Reg. 115420-18 and Revenue Ruling 2018-29 released by the Treasury on October 19, 2018, provided much needed clarification to the QOF process described in I.R.C. 1400Z-1. The process is intended to be very flexible, however, there are specific requirements and limitations. A QOF must hold 90% of its assets in “OZ property,” with some flexibility to allow the QOF to hold working capital and capital designated to substantially improve the OZ property. It appears that shares in an Opportunity Zone Business may qualify as OZ property.

Certification: To become an eligible QOF, the taxpayer self-certifies by completing an IRS Form. No approval or action by the IRS is required. Per IRS guidance, taxpayers will use Form 8996, Qualified Opportunity Fund, both for initial self-certification and for annual reporting of compliance with the 90-Percent Asset Test in section 1400Z-2(d)(1) for relevant tax years.

Penalties: If a QOF fails to meet the 90 percent investment requirement, then it must pay a penalty for each month it fails to do so. The penalty is (i) the amount equal to 90 percent of its aggregate assets, over (ii) the aggregate amount of QOF property held by the fund, multiplied by (iii) the underpayment rate established under IRC §6621(a)(2) for each month the Fund fails to meet the required threshold.

Benefits to Investors:

Investors can defer tax on capital gains reinvested in a QOF until the earlier of the date on which the QOF investment is sold or exchanged, or December 31, 2026, if the proper deferral elections are made. The payment of deferred taxes effectively serves as a price of entry to the program. The QOF investments can also qualify for the following tax benefits: (i) a 10% reduction in capital gains liability, if the investment is held for 5 years (1400Z-2(b)); (ii) a 15% aggregate reduction if held for 7 years (1400Z-2(b)); and (iii) an exclusion from capital gains tax on post-acquisition gains generated from the QOF investment (reinvested capital gains only) after it is held for 10 years (1400Z-2(c)). Investors do not have to live in the OZ to take advantage of the tax benefits.

Substantial improvement and original use requirements: In order to qualify for tax benefits, a QOF must purchase and “substantially improve” OZ property or the property’s “original use” in the OZ must begin with the QOF (the QOF or an operating subsidiary must acquire the OZ business property after 2017, by purchase).

“A building located on land within a QOZ is treated as substantially improved within the meaning of § 1400Z-2(d)(2)(D)(ii) if, during any 30-month period beginning after the date of acquisition of the building, additions to the taxpayer’s basis in the building exceed an amount equal to the taxpayer’s adjusted basis of the building at the beginning of such 30-month period.” Rev. Rul. 2018-29

“If a QOF purchases an existing building located on land that is wholly within a QOZ, the original use of the building in the QOZ is not considered to have commenced with the QOF for purposes of § 1400Z-2(d)(2)(D)(i), and the requirement under § 1400Z-2(d)(2)(D)(i) that the original use of tangible property in the QOZ commence with a QOF is not applicable to the land on which the building is located.”

Rev. Rul. 2018-29

See Rev. Rul. 2018-29 and Proposed Treasury Regulation 115420-18 for specific details and guidance.

Additional guidance will be forthcoming: Proposed Treasury Regulation 115420-18 was released on October 19, 2018 along with drafts of Form 8996 and its accompanying instructions. These proposed regulations list open questions and are subject to public comments and hearings. Final guidelines are far from being released and there is still substantial uncertainty surrounding certain aspects of the program.

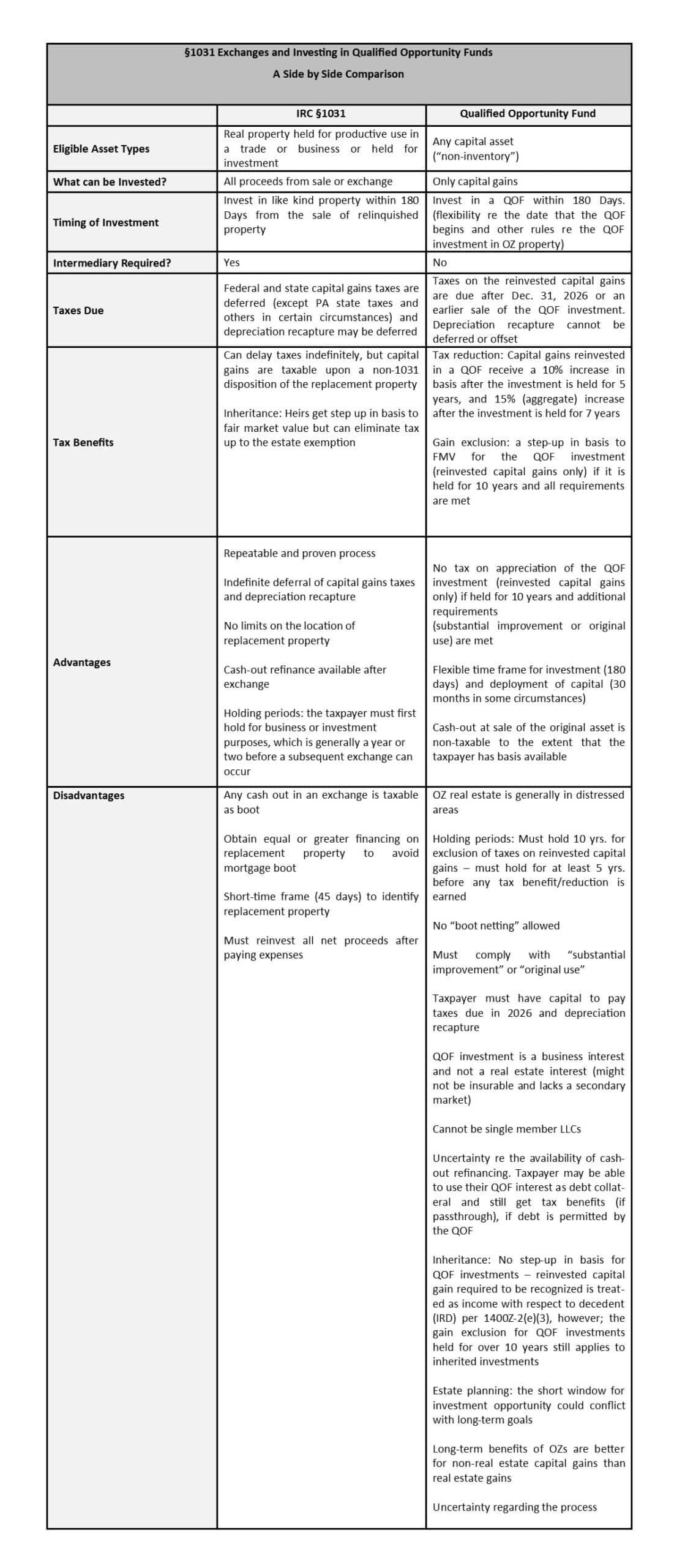

OZs versus Like-Kind Exchange IRC §1031: Taxpayers can defer paying capital gains taxes resulting from the sale of any capital asset (non-real estate or real estate) by reinvesting in a QOF. In contrast, 1031 exchanges are only available to taxpayers selling real estate. Unlike 1031 Exchanges, where investors can buy like-kind property anywhere in the United States, QOF investors are required to purchase property in OZs, which limits the pool of properties to consider. Another major difference is that, QOF investments are business interests and not real estate interests. Therefore, a taxpayer would not be able to exchange into a QOF interest because it is not like kind property. Likewise, a taxpayer would not be able to exchange a QOF interest itself for replacement property. However, it is unclear if the QOF entity itself would be able to exchange capital gains from investments in OZ property that are not eligible for gain exclusion (basis step-up to FMV) under 1400Z-2(c) – for example, gains in a QOF interest attributed to an investment of additional cash or financing. In addition, a deferral of capital gains taxes and depreciation recapture using a 1031 exchange is indefinite as opposed to a QOF investment, which does not defer recapture and imposes a hard deadline/requirement for payment of capital gains taxes (December 31, 2026). Finally, in order to see substantial benefit from a QOF investment, a taxpayer must hold the investment for at least 5 years (10 years to reap the major tax benefit), compared to the holding period requirement for 1031 property which generally is a year or two before it is safe for the taxpayer to conduct a subsequent exchange.

Links to IRS Regulations and Guidance

26 U.S. Code Section 1400Z-1 and 14ooZ-2: http://uscode.house.gov/view.xhtml?path=/prelim@title26/subtitleA/chapter1/subchapterZ&edition=prelim

Rev. Proc. 2018-16: https://www.irs.gov/pub/irs-drop/rp-18-16.pdf

Proposed Regulations Press Release: https://www.irs.gov/newsroom/treasury-irs-issue-proposed-regulations-on-new-opportunity-zone-tax-incentive

Proposed Regulation 115420-18: https://www.irs.gov/pub/irs-drop/reg-115420-18.pdf

Revenue Ruling 2018-29: https://www.irs.gov/pub/irs-drop/rr-18-29.pdf

IRS FAQS (updated 1/11/19): https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions

Links to General information on OZs

EIG information and map: http://eig.org/opportunityzones

CDFI fund: https://www.cdfifund.gov/pages/opportunity-zones

Congressional Research Service study: https://fas.org/sgp/crs/misc/R45152.pdf

Legal 1031 does not provide tax or legal advice, nor can we make any representations or warranties regarding the tax consequences of any transaction. Taxpayers must consult their tax and/or legal advisors for this information. Unless otherwise expressly indicated, any perceived federal tax advice contained in this article/communication, including attachments and enclosures, is not intended or written to be used, and may not be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any tax-related matters addressed herein.

Copyright © 2019 Legal1031. All rights reserved.