Q.1 What is a §1031 Exchange?

An IRC §1031 tax deferred exchange allows owners of real property to defer the recognition of a capital gains tax they would have recognized when they sold their property. Exchanging allows investors to reinvest money into new business or investment properties that would otherwise have been paid to the government as a capital gains tax. Tax deferred exchanges are not new – they have been available in one form or another since 1921, and in its current format since 1986. In order to structure a transaction as an IRC §1031 tax deferred exchange a taxpayer would follow the steps contained in our Checklist.

Simply put, an exchange is structured as a sale, just like any other sale, and a purchase, just like any other purchase, but with the inclusion of a qualified intermediary to structure the transaction as an exchange. It is very important to involve the qualified intermediary before you start your transaction. Without the involvement of a qualified intermediary before the sale of the relinquished property the proceeds become taxable and any proceeds used to acquire replacement property are with after-tax dollars.

Q.2 What is a Qualified Intermediary?

Legal 1031 Exchange Services, LLC is a qualified intermediary. A qualified intermediary is an independent third party to the transaction whose function is to prepare the documents necessary to create the exchange, as well as to act as the independent escrow agent for the exchange funds. The qualified intermediary is defined by the Treasury Regulations and may not give tax or legal advice.

A qualified intermediary may not be a “disqualified person” as further defined in the Treasury Regulations. A disqualified person normally includes, but is not limited to, your attorney, CPA or accountant, realtor, agents, employees, relatives, and entities in which you have an interest. It is important to perform some due diligence when choosing a Qualified Intermediary to structure your transaction. At Legal 1031 Exchange Services, LLC we pride ourselves on our knowledge, customer services, and security of the 1031 exchange funds held in escrow for our clients.

Q.3 What is Like-Kind property?

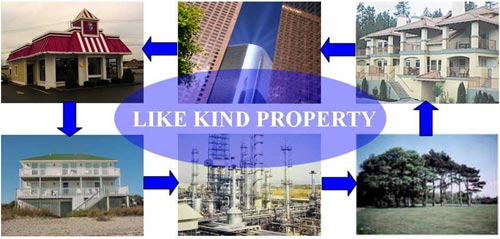

One of the most misunderstood concepts of tax deferred exchanges is the concept of like kind. Many people wrongly believe that like kind means the same type of property must be purchased when completing an exchange. Nothing can be further from the truth. Exchangers can sell one type of property and buy a completely different type of property as is explained below.

The relinquished property must be held for productive use in a trade or business, or for investment purposes, and be exchanged for property that is also to be held for productive use in a trade or business, or for investment purposes. IRC 1031(a)(1). However, real property can only be exchanged for real property. Exchangers can look to a combination of federal and state law to help determine if an asset is real property for purpose of the like-kind requirement. For more information, please see our Article about Treasury Regulation §1.1031-1(a)(3) (December 2020). Treas. Reg. §1.1031(a)(3) is generous to investors and defines “real property” for 1031 purposes in a very broad manner. Historically, taxpayers had to analyze varying state and local guidance, common law, and non-binding IRS rulings in order to make determinations if property was considered “real” for 1031 purposes. See Aquilino v. United States, 363 U.S. 509 (1960). Furthermore, “like-kind” only refers to the nature or character of the property, not to its grade or quality. Treas. Reg. §1.1031(a)-1(b).

What this means is that exchangers have the opportunity to purchase replacement property of any type. For example, an exchanger can sell vacant land and buy a strip mall; or sell an apartment building and buy a net leased property. It also means that Exchangers have the opportunity to exchange intangible interests in real estate such as air rights, easements, tenant-in-common interests, options, leases, conservation easements, oil and mineral rights, and development rights for similar rights or even for more traditional rights like fee interests, if the rules say they are like-kind. The graphic below illustrates how all property held for business or investment purposes is like-kind to all other property held for business or investment purposes.

Q.4 How do you identify property?

The Exchanger has 45 days from the date of the sale of the relinquished property to identify the potential replacement properties. The identification is a written letter or form which is signed and dated by the taxpayer, and contains an unambiguous description of the property. A property that is identified is not required to be under contract or in escrow to qualify. Exchangers acquiring an undivided percentage interest (“fractional interest”) in a property should identify the specific percentage that will be acquired.

The Exchanger may change the properties identified as often as it wants during the 45 day identification period by revoking the previously identified properties and then identifying new potential replacement properties. It is essential that the identification is delivered before midnight of the 45th day, or postmarked by the 45th day, to the Exchanger’s Qualified Intermediary or to a party related to the exchange who is not a disqualified person. Typically, delivering the identification to the Qualified Intermediary is the safest course of action to prevent disqualification of the transaction for an invalid and/or untimely identification. If the Exchanger fails to deliver the identification in a timely fashion or does not comply with one of the three identification options, the exchange will be disallowed.

Unfortunately, there are restrictions on the number or value of the properties an exchanger identifies. To qualify for a 1031 exchange, the exchanger must comply with one of the following identification options:

1) The Three Property Rule: the “three property” identification rule allows an Exchanger to identify up to three replacement properties. There is no value limitation placed upon the prospective replacement properties and the exchanger can acquire one or more of the three properties as part of the exchange transaction. The “three property” rule is the most commonly used identification option, allowing an exchanger to identify fall back properties in the event the preferred replacement property cannot be acquired.

2) The 200% Rule: the Exchanger can identify an unlimited number of properties, provided that the total value of the properties identified does not exceed 200% of the value of all relinquished properties. There is no limitation on the total number of potential replacement properties identified under this rule, only a limitation on the total fair market value of the identified properties.

For example, if an Exchanger sold relinquished property for $1,000,000 under the 200% rule, the Exchanger would be able to identify as many replacement properties as desired, provided the aggregate fair market value of all of the identified properties does not exceed $2,000,000 (200% of the $1,000,000 sales price of the relinquished property).

3) The 95% Exception Rule: the Exchanger may identify an unlimited number of replacement properties exceeding the 200% of fair market value rule, however the Exchanger must acquire at least 95% of the fair market value of the properties identified. This rule is utilized in limited circumstances as there is a much higher risk of the transaction failing.

For example, assume an Exchanger identifies ten properties of equal value. In order to satisfy the rule, the Exchanger would be required to acquire all ten identified properties within the exchange period to complete a successful exchange. If one of the properties fell through, the entire 1031 exchange would be disqualified because the exchanger did not acquire 95% of the fair market value identified. This rule should only be utilized in situations where there is a high level of certainty pertaining to the acquisition of the identified properties and the other two rules do not meet the Exchanger’s objectives.

Legal 1031 Exchanges Services, LLC provides each of its exchangers with a property identification form as part of our standard set of exchange documents.

Q.5 What is the structure of a delayed exchange?

An exchange is basically a sale just like any other sale and a purchase just like any other purchase, however, you must work with a qualified intermediary before you start your exchange.

Tax deferred exchanges are normally structured as one of four variants: simultaneous, delayed [Treas. Reg. 1.1031(k)-1(a)], reverse [Revenue Procedure 2000-37], and build-to-suit. In the case of a simultaneous or delayed exchange, the exchanger first enters into a contract to sell the relinquished property or properties. Contrary to popular belief there is no “exchange contract” for a delayed exchange. The exchanger enters into a contract that they would normally use if they were not structuring the transaction as an exchange. However, the addition of an exchange cooperation clause is recommended to secure the cooperation of the buyer or seller of the relinquished property or replacement property, respectively.

Q.6 What kind of due diligence should I do when picking out a qualified intermediary?

When choosing a Qualified Intermediary it is important to look for the following items:

1. What is the experience of the person who you are speaking with? How long have they been in the industry? How often do they lecture on IRC §1031 tax deferred exchanges? Are they a published author, and were the articles published in a major legal publication such as a law journal? Are they a tax or legal professionals such as an attorney or CPA? Remember, the person on the other end of the phone may be from a big company but may only have a few months experience. It is important to ask!

2. Does the Qualified Intermediary segregate the Exchange Funds into separate Qualified Escrow Accounts as provided in the Treasury Regulations or do they co-mingle the Exchange Funds? A Qualified Intermediary that uses internal “memorandum accounts” is not providing you or your client with the maximum protection that the Safe Harbors of the Treasury Regulations allow. Legal 1031 Exchange Services, Inc. only uses segregated accounts and can provide you with deposit verification letters directly from our depository bank.

3. Have you received a copy of the Fidelity Bond and Errors & Omissions coverage before you have started your Exchange? Is the amount of coverage for each transaction greater than the cash proceeds you will be sending? Have you verified that the Fidelity Bond and E&O coverage are in full force and effect? And perhaps most importantly, does the Fidelity Bond provide for principal liability? Many Fidelity Bonds only provide protection from employee malfeasance but leave the Exchanger uninsured in the case of malfeasance of a principal. Remember a Qualified Intermediary will be holding onto your funds or your client’s funds. It is imperative that you do some due diligence.

It goes without saying that service is an extremely important part of an IRC §1031 tax deferred exchange. Exchanges are subject to strict guidelines and requirements. Unless you can receive your exchange documents in a timely fashion and have your exchange proceeds readily available for the purchase of the replacement property then it could potentially invalidate your 1031 Exchange. It is important that you are able to reach the people who have the expertise and have the ability to close your transaction in a timely fashion.

Legal 1031 Exchange Services, LLC does not provide tax or legal advice, nor can we make any representations or warranties regarding the tax consequences of your exchange transaction. Property owners must consult their tax and/or legal advisors for this information. Our role is limited to serving as qualified intermediary to facilitate your exchange. © 2021 Legal 1031 Exchange Services, LLC. All rights reserved.