One of the most misunderstood concepts of tax deferred exchanges is the concept of “like-kind.” Many people wrongly believe that like-kind means the same type of property must be purchased when completing an exchange. Nothing can be further from the truth. An Exchanger can sell one type of property and buy a completely different type of property as is explained below.

The relinquished property must be held for productive use in a trade or business, or for investment purposes, and be exchanged for property that is also to be held for productive use in a trade or business, or for investment purposes. IRC §1031(a)(1). However, real property can only be exchanged for real property. Do note that domestic/U.S. real estate is only “like-kind” to domestic/U.S. real estate, and foreign/international real estate is only “like-kind” to other foreign/international real estate. Therefore under §1031, international real estate cannot be exchanged for U.S. real estate and vise-versa. For additional information on international 1031 exchangers, check out our article here.

Exchangers can look to a combination of federal and state law to help determine if an asset is real property for purpose of the like-kind requirement. For more information, please see our Article about Treasury Regulation §1.1031-1(a)(3) (December 2020). Treas. Reg. §1.1031(a)(3) is generous to investors and defines “real property” for 1031 purposes in a very broad manner. Historically, taxpayers had to analyze varying state and local guidance, common law, and non-binding IRS rulings in order to make determinations if property was considered “real” for 1031 purposes. See Aquilino v. United States, 363 U.S. 509 (1960). Furthermore, “like-kind” only refers to the nature or character of the property, not to its grade or quality. Treas. Reg. §1.1031(a)-1(b).

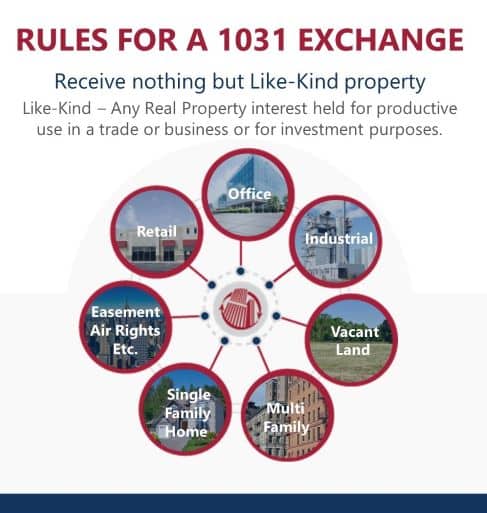

What this means is that exchangers have the opportunity to purchase replacement property of any type. For example, an exchanger can sell vacant land and buy a strip mall; or sell an apartment building and buy a net leased property. It also means that Exchangers have the opportunity to exchange intangible interests in real estate such as air rights, easements, tenant-in-common interests, options, leases, conservation easements, oil and mineral rights, and development rights for similar rights or even for more traditional rights like fee interests, if the rules say they are like-kind.

In order to have a valid tax deferred exchange, real property must be held for productive use in a trade or business, or for investment purposes, and be exchanged for real property that is to be held for productive use in a trade or business, or for investment purposes. See IRC 1031(a)(1). The graphic on the left illustrates how all property held for business or investment purposes is like-kind to all other property held for business or investment purposes.

However, real property can only be exchanged for real property, and cannot be exchanged for personal property, stocks, partnership interests, or beneficial interests in a trust as they are not like kind to each other per IRC §1031(a)(1). Keep in mind that for tax years beginning after December 31, 2017, Section 1031 was limited to real property by the Tax Cuts and Jobs Act. Prior to this change in the law, exchanges of like-kind personal property for personal property were possible.

In addition, “like-kind” only refers to the nature or character of the property, not to its grade or quality. Treas. Reg. 1.1031(a)-1(b). Accordingly, it does not matter if you exchange a property zoned for residential use for another property zoned for commercial use. So long as both properties are held for business or investment purposes the exchange will be valid. It is a broad standard.

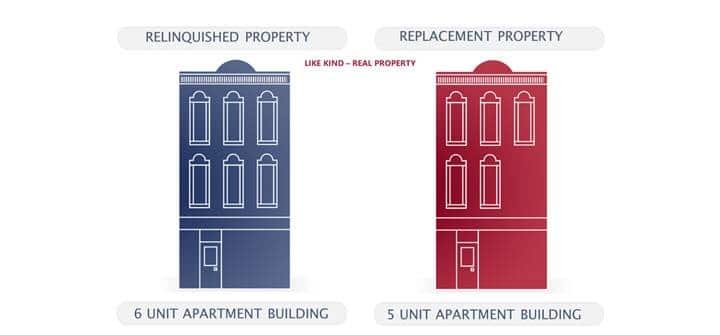

Nowhere is this concept better illustrated than the typical scenario where an exchange client sells a six-unit apartment building and thereafter seeks to purchase a five-unit apartment building. Time and again the exchanger will explain how he or she has already lined up a contractor to subdivide one of the apartments to make six “like-kind” apartments. Similarly, it is no different where exchangers try to buy the same acreage of vacant land, the same square footage office building, or the same type of two-family house.

The above apartment buildings are still “like kind” to each other despite some small differences.

Legal 1031 Exchange Services, LLC does not provide tax or legal advice, nor can we make any representations or warranties regarding the tax consequences of your exchange transaction. Property owners must consult their tax and/or legal advisors for this information. Our role is limited to serving as qualified intermediary to facilitate your exchange.

© 2021 Legal 1031 Exchange Services, LLC. Updated 2023. All rights reserved.